[Investing Made Easy] A Series of Unfortunate Mistakes - Episode #1

Let's cut the B.S. and Break the Codes for once. Let's talk about failure before we talk about success. Let's discuss about all my investing mistakes before how to become a Successful Investor!

Before starting, something I forgot to mention: the newsletter format!

I am actually maintaining two different newsletters:

“Investing Mad(e) Easy”

The one you’re currently reading: for investors based in Singapore (Whose their fiscal residence is in Singapore)

“Investing Mad(e) in France”

For French investors (Whose fiscal residence is in France, or still have active financial products in France while living outside of France, or expats planning to get back to France)

Because coming out with ideas, and writing requires a lot of time (I have a full time job), I will only be able to provide fortnightly/bi-monthly (Hopefully every Tuesday morning) newsletters for each “sector”, meaning:

Week 1: Singapore - Mad(e) Easy

Week 2: France - Mad(e) in France

Week 3: Singapore - Mad(e) Easy

Week 4: France - Mad(e) in France

Let’s go!

In this “Series of Unfortunate Mistakes” that will last with few episodes, we will go through the biggest mistakes I have made since the beginning of my investing period.

GOLD !

My first mistake ever. In August 2011, all the media kept talking and bragging about Gold:

“Gold is skyrocketing! Don’t miss out!”

“Nothing can stop Gold! Invest now!”

“Gold is a safe haven in times of crisis, you must absolutely own some”

“In Gold we trust”

Well, I got screwed! The media got me, like they got us all, at least once in our lifetime. For some of us, the media and the big financial institutions are still screwing us and considerably reducing our nest egg by charging high fees and giving us wrong and/or biased advice.

At that time, I was 21 years old and was just getting started with my Master’s Degree.

Obviously, I had NO MONEY, except for a few bucks I was making during summer jobs (1,000 Euros per year), and had to last the whole student year!

But the media were able to manipulate me and my brain: I started to be greedy and had FOMO.

But I didn’t want paper Gold because at that time while doing my research on Google, I found out that there was much more paper Gold sold on the market than actual physical gold available on Earth. So I thought I was having an edge here knowing this information.

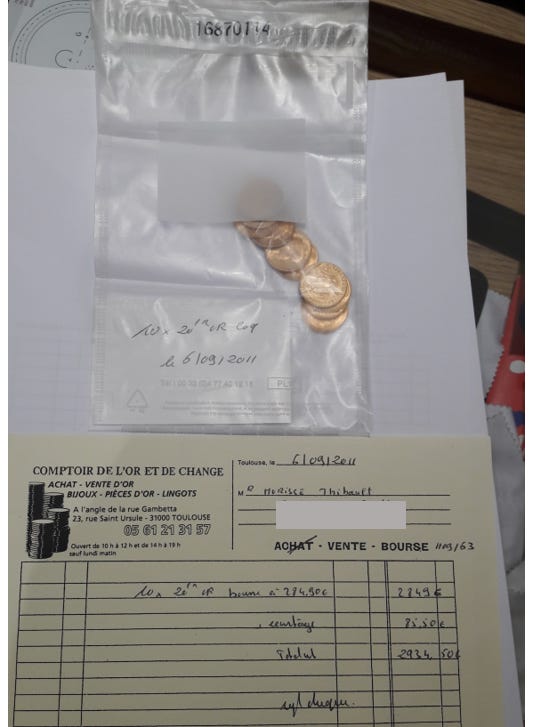

I started looking for the cheapest coin expert/numismatist (= lowest trading fees) available in my city (Toulouse), then on the 6th September 2011, I finally wrote my biggest check and bought 10 coins of 20 Francs Napoleon, physical gold! Yippee! En route for the billions! “I am about to become a billionaire!”

My adrenaline was at its highest.

Sum-up of the purchase costs:

Gold: 2849 Euros

Trading fees: 85.50 Euros (3.00%)

Total: 2934.50 Euros

In France, physical gold prices are available at https://www.cpordevises.com/

To know more about 20 Francs Napoleon, this is here: https://www.cpordevises.com/or/produits-cotes/20-francs-napoleon

And the disappointment started year after year. So in August 2018, I decided to sell it all after a loss of 35% over 7 years !

Sum-up of the sale costs:

Gold: 1900 Euros

Trading fees: 57 Euros

Total gotten back: 1843.00 Euros

Now, grand total sum-up: how much I really lost?

Way 1

Loss on the Gold itself: 1900 - 2849 Euros = 949 Euros

Trading fees: 85 + 57 Euros = 142 Euros

Way 2

Loss on the Gold itself: 2934.50 - 1843.00 Euros

Total Loss: 1091.00 Euros

But how did the Gold ETFs do during the same period?

Same!

“This is probably because you were owning physical gold traded in France only. I am holding paper Gold and I am doing much better!”

Do you see any consistency in the below two charts and the 20 Francs Napoleon one? I do.

https://finance.yahoo.com/chart/GLD

https://finance.yahoo.com/chart/IAU

If you’re still curious/interested to know more about Gold ETF, this is a list of all Gold ETFs traded in the USA: https://etfdb.com/etfs/commodity/gold/

Learnings

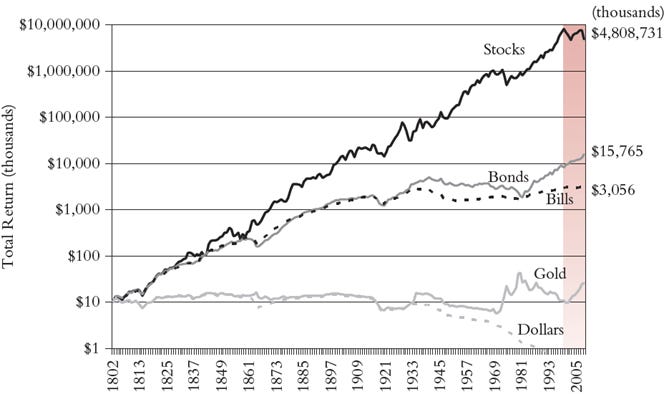

Gold (paper or physical) will not make you rich over the long run.

If you invested in September 2011 like I did, your return would have only gone positive as I write this newsletter: October 2020. Almost 10 years later! That reminds me the “Lost decade” from 2000 to 2008. We will discuss this topic in another newsletter, too.

Gold didn’t even beat the inflation (~ 2% / year)

This also means that you would have been loosing purchasing power since your money was losing 2% of value every year, for almost 10 years.

2011 $ 10,000

2012 $ 9,800

2013 $ 9,604

2014 $ 9,412

2015 $ 9,224

2016 $ 9,039

2017 $ 8,858

2018 $ 8,681

2019 $ 8,508

2020 $ 8,337

Conclusion: You would not have lost nothing 10 years later even though you may think so. You would have lost $1,600, i.e. 16% of $10,000!

So that also means that did not I only lose 1,091 Euros, but 2% of inflation per year for 7 years. If we assume I’ve lost it all from Year 1, I have actually ended up with a loss of more than 1,200 Euros, i.e. 40%!

Owning gold is not investing, this is speculating.

“Yes, but I bought when it was low because I knew it would rise again”

That’s called market timing, and this is a bad idea. You may just have ended like me.

You didn’t know it would rise again: this was pure luck.

Never invest in gold if you expect a steady annual return of 7-10%.

If you are looking for some sort of stability or protection during correction, bear market or massive crash, there are other financial instruments available

Owning physical gold is not liquid.

My two cents

Get rid of any gold ASAP even though you have to take in a loss. It is painful but it is better than seeing your money stagnate or even melt throughout the weeks, months, and years, hoping for a rebound. If you are in this situation, put your pride aside for a moment, and do it!

This is personally what I did (Better late than never) and I am super happy because I was able to use what was left and invest it in the right way!

Another information that really convinced me to sell gold ASAP and invest it in stocks is the below chart, showing their respective returns for a period of 200 years (1802 – 2008). I believe the chart speaks for itself:

Source: “A random walk down Wall Street” & Vanguard

Next!

Another mistake in the next newsletter!

Not sure to understand, what do yo umean by Owning physical gold is not liquid?

May be a bland statement! But physical gold is always on the rise as far as I can remember! I never see it went down! Not comparing it against the stocks/bonds, but for the value for money, returns you get on it is amazing too. To give an example, One Sovereign of gold was 400+$ in 2018 and 600$ in 2020. I bought 20 Sovereign in 2018, gains for me is close to 35%

Although the price of gold can be volatile in the short term, it has always maintained its value over the long term. Through the years, it has served as a hedge against inflation and the erosion of major currencies, and thus is an investment well worth considering. So the paper gold may not be something to look up but Physical one in my view is yes!

Indeed, Gold is a tricky play and should not be more than 8% of your portfolio some say (Mr Dalio)... as a rule of thumb, it is usually negatively correlated to the 10 yrs US treasury bond and US dollar value. If the 10yrs US treasury bonds are below the targeted inflation by the FED or are approaching zero %, gold becomes more attractive as it potentially will have an equal or higher return. If the dollar weakens, it also makes the gold more attractive for a foreign investor buying it with US dollars. I am keeping an eye on these two factors while cautiously investing in paper gold.